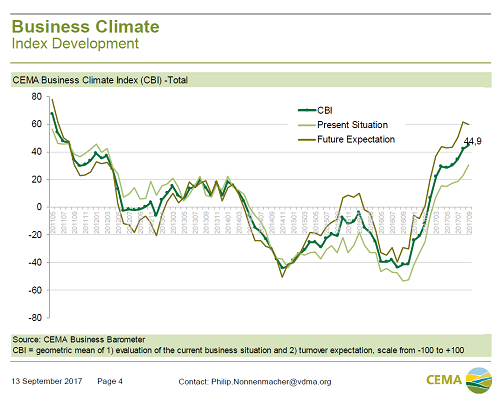

The general business climate index of the agricultural machinery industry in Europe maintains its upward trend, scoring the highest value since 2012. Improvements in the livestock and the tractor business have notably contributed to the current favourable situation.

Accordingly, forecasts remain very positive. Among the surveyed companies, a clear majority of 80% in 2017, and 94% for the first 2018 outlook expect a total turnover’s growth.

Last month orders’ intake for harvesting and livestock equipment remain high from EU markets, but significantly less dynamic for arable equipment which has stronger demand from outside Europe.

In all European markets, most of the surveyed companies expect turnover increases in the next six months. The CIS countries lead the ranking while Belgium holds the last position, due to extreme income losses in the past year. Spain, Czech Republic and Slovakia remain again in the lower range due to poor harvest prospects. This said, Czech Republic and Slovakia are evaluated to have the highest investment needs among the European markets.

Finally, it seems only end-users from Poland and the CIS countries have strong needs to enlarge or replace agricultural machinery.