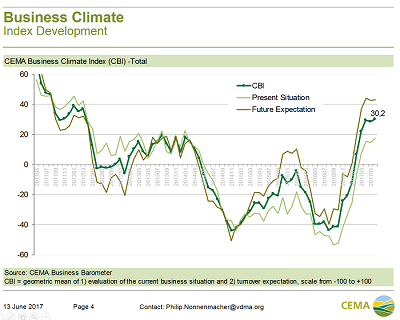

In June, the industry business mood remains firmly positive, reaching the highest value since 2012. The European industry’s forecast for 2017’s total turnover has further improved. 62% of surveyed company representatives expect a moderate growth between 1-9%. Only 10% of respondents expect a decline.

Based on the past and current order intake, turnover is secured to rise in the coming months. However, uncertainty remains as regards to the question whether the next six months will bring an increase of order intakes.

Currently, business for arable equipment is running best, followed by components - in both areas, manufacturers once again show excellent values on all indicators. The product segment of lawn garden and municipal equipment experiences the weakest expectations, indicating saturation of the market after a steady growth phase. At the same time, especially for livestock equipment, the divergence between future expectations and current business evaluation is persisting. Livestock equipment has great expectations, but the weakest current business evaluation across all segments.

On a regional basis, the expectations for all major markets have risen to similarly good levels. Though not euphoric, recovery in Poland seems to further solidify. Spain has deteriorated due to bad weather conditions. The French market has improved significantly regarding expectations. However, most of the French manufacturers see themselves in an unfavorable condition. Only companies from Belgium rate their situation worse.