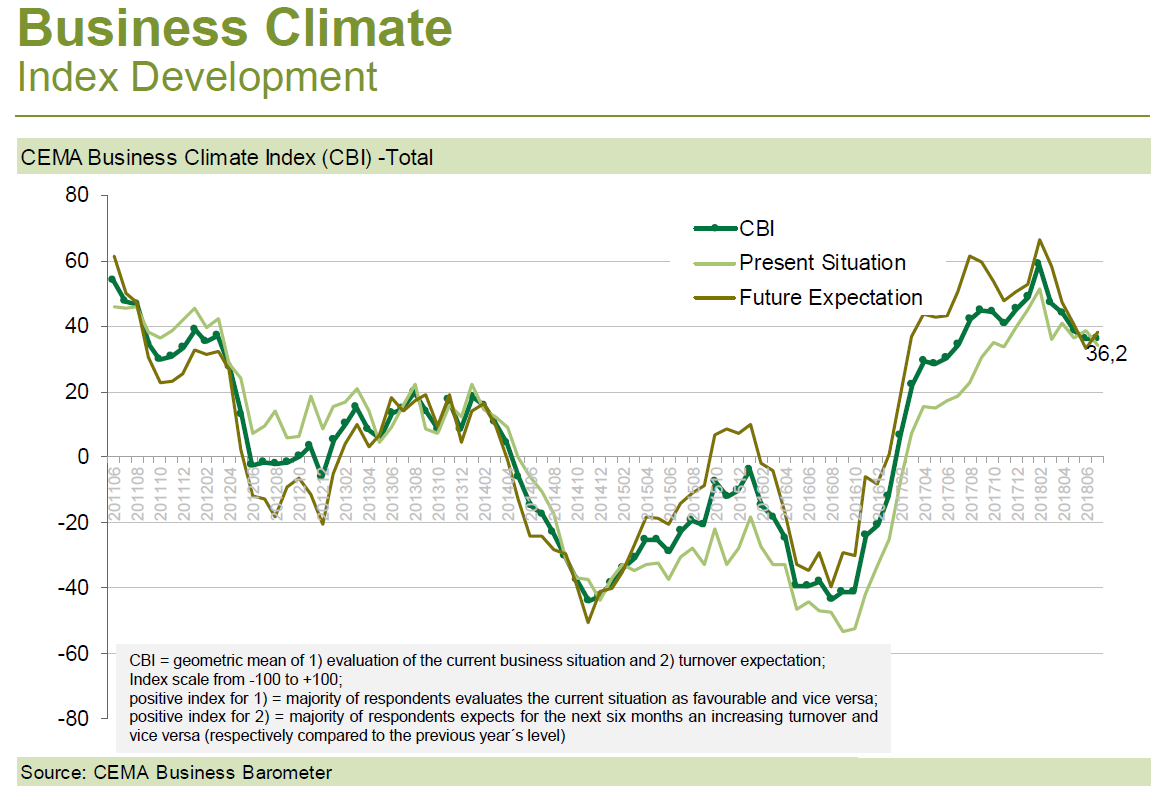

The general business climate index of the agricultural machinery industry in Europe has moved sideways on high level after some deterioration in the previous months.

Based on the incoming orders from the past months, every second company expects an increasing turnover for the coming six months. However, only one third expects the order intake to further increase.

The business climate for the transportation and livestock equipment continues to be far above the industry average. Business climate within the tractor segment has meanwhile converged close to the average. Manufacturers of arable equipment show the widest spread regarding evaluation of the current business and are more divided in their expectations for the coming six months.

The June order intake from Europe has been mixed for arable equipment and mostly negative for components. For all other segments it has been mostly growing, especially for harvesting machinery.

For the major European markets, a clear majority of survey participants expect turnover increases. Poor harvest expectations might be the reason for a decreasing confidence in Poland and other markets in Eastern Europe like Czech Republic and Romania. At the bottom of the confidence ranking remain the Netherlands, the Scandinavian and the CIS countries. Accordingly, the latter two markets show the highest dealer stock levels.