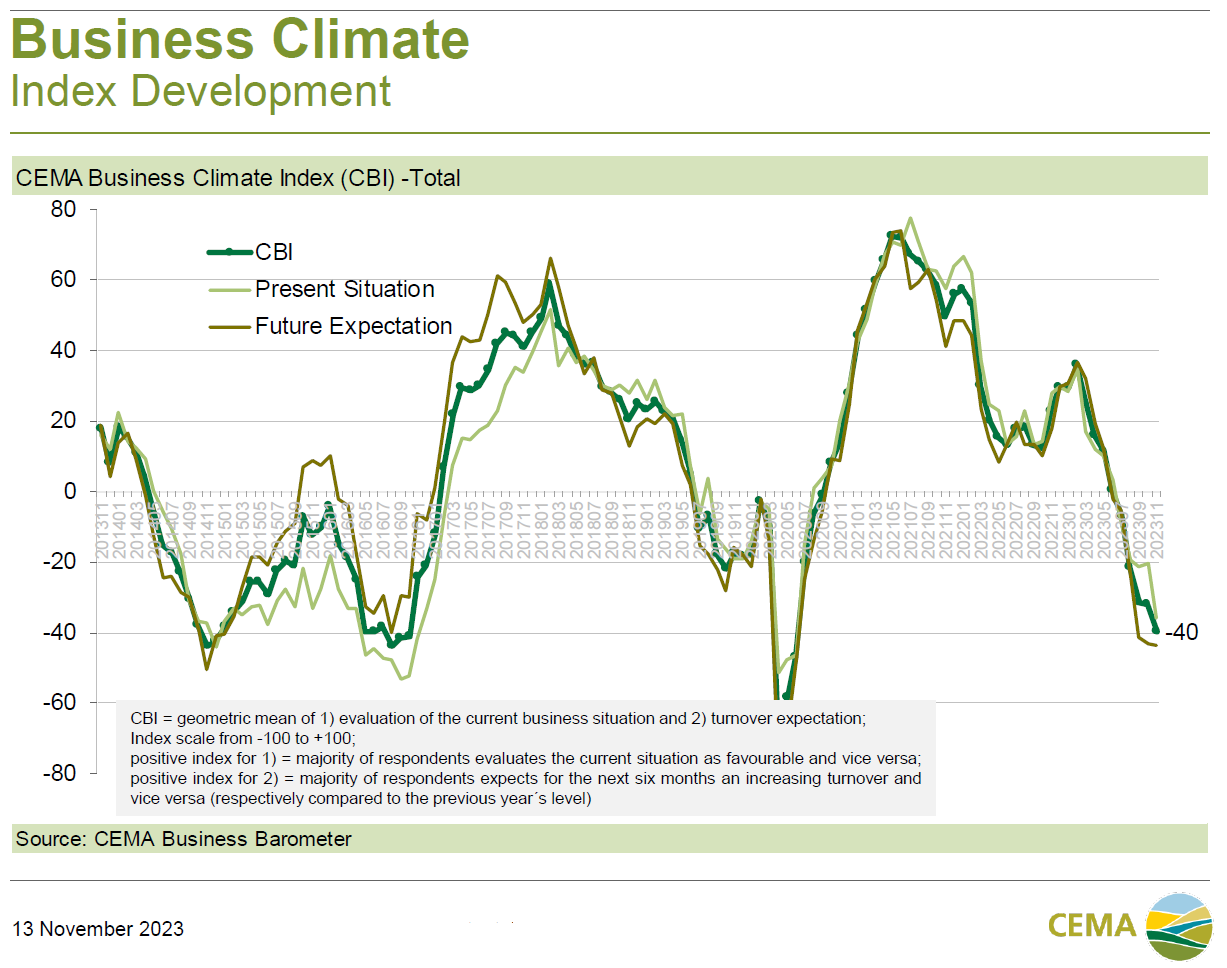

The general business climate index for the agricultural machinery industry in Europe has continued to drop and is thus moving further towards deep recession territory. In November, the index decreased from -32 point to -40 points (on a scale of -100 to +100).

More than half of the survey participants consider current business to be unfavorable and expect their turnover to decline in the next six months. With a view to the coming order intake (an indicator which is not considered in the calculation of the overall barometer index), meanwhile only a negligible 4% of survey participants expect increases.

The index for tractor manufacturers has fallen to -57 points, which is one of the lowest values in the history of the survey. Among component manufacturers, a very large discrepancy has emerged between the evaluation of current business (which 60% still regard as "good") and future expectations (which are very negative).

After order backlogs had peaked at the beginning of the year, the volume of orders has seen a repeated significant reduction and is now corresponding to a production period of 3.6 months, which is still relatively high in a long-term comparison, but substantially lower than at any time in the past two years. Meanwhile, less than 40% of manufacturers have an order volume of more than 3 months. One year ago, the share was over 80%, and in August of this year it was still at around 60%.