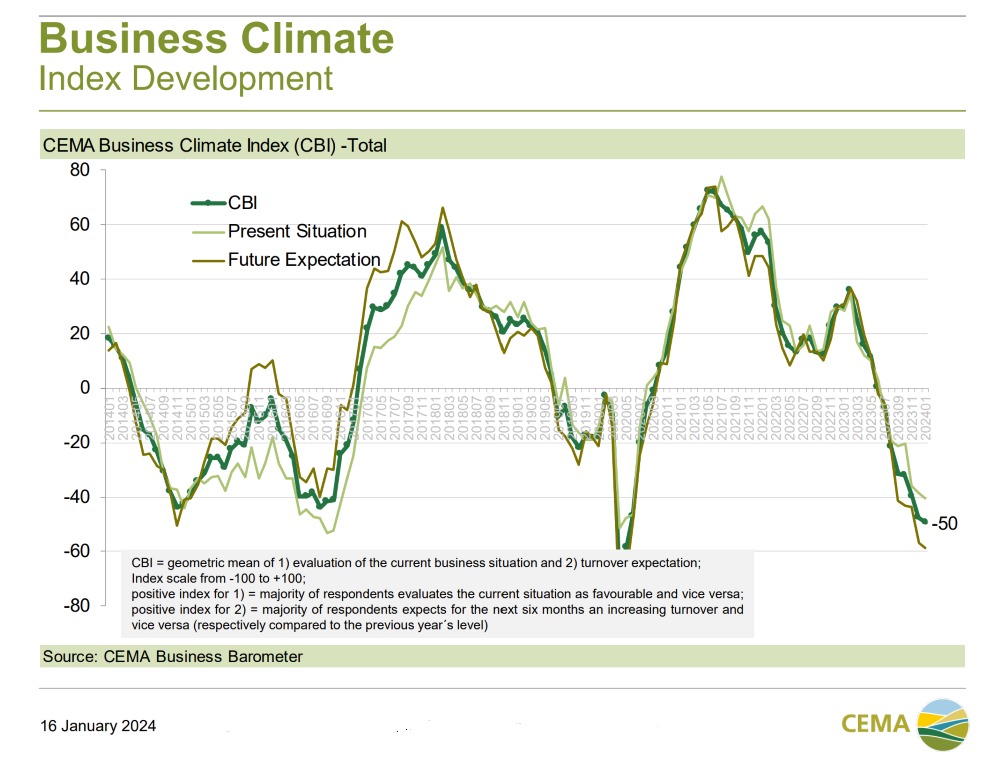

The general business climate index for the agricultural machinery industry in Europe has continued its downward slide in the area of deep recession. In January, the index decreased from -48 to -50 points (on a scale of -100 to +100).

Once again more than half of the survey participants consider the current business situation to be unfavorable and even two thirds expect their turnover to decline in the coming six months.

The survey confirms also again that the direct customers of the manufacturers, the dealers, are not able to pass on their numerous orders to the end customers. According to the survey, the dealer stocks are in most European markets significantly higher than in the year 2019, which went down in history due to high dealer stock levels.

Correspondingly, there is not one single European market for which a majority of survey participants would have positive turnover expectations. For Western Europe and the Nordic countries, the confidence levels are not as negative as for Central and Eastern Europe. One exception is Germany, for which the overall confidence is also very weak (only 14% expect growth in this market while more than 60% expect a significant decline).