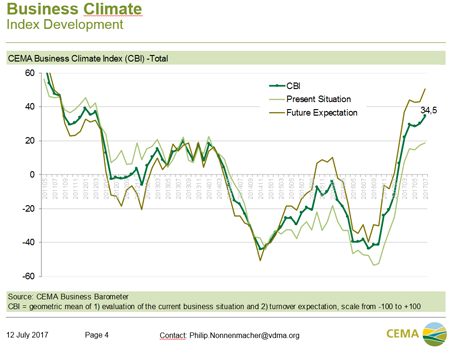

The general business climate index of the agricultural machinery industry in Europe continues on boom path. Again this month the index gets the highest values since 2012.

Based on the past and current order intake, turnover seems secured to rise in the coming months. In the last month, orders from outside of Europe have gained additional momentum.

Within the EU markets, a majority of surveyed participants expect a turnover increase for the next six months. For Poland, although results on the tractor market show only little growth, expectations have further solidified. In Germany, the market is already growing and expectations are once again solidifying. Spain has further deteriorated due to bad weather conditions (drought). The expectations for France and Italy are partly mixed, depending on region and segment, companies report increasing order intakes, others a drop. Finally, the CIS countries have lost some of their dynamics, suggesting that the peak has already been reached.

As regards components, manufacturers show once again excellent values on all indicators.

Looking at product segment, business for arable equipment is again running best. However, the future expectations slightly decreased, probably due to worsened harvesting expectations for some regions in Europe. At the same time, especially for livestock equipment, the divergence between future expectations and current business evaluation is persisting. Nonetheless, livestock equipment has the best expectations after components, but the worst current business situation.