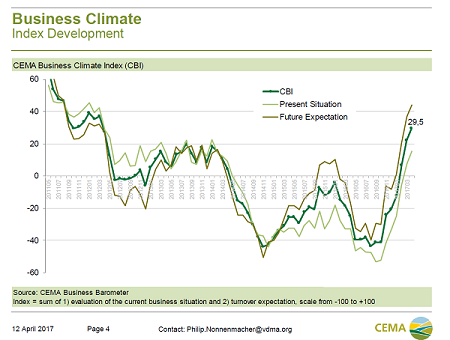

The industry’s business climate index has reached its highest value since 2012. Future expectations have risen more sharply than the current business situation showing a new divergence between these two variables.

In April, only 9% of the surveyed industry representatives expect a decreasing turnover for the next six months. In particular, future expectations for arable equipment manufacturers have greatly improved surpassing the total industry average.

As regards dealer stocks of new equipment, levels are below the average of the past three years in all European countries except for Poland. Nevertheless, most of manufacturers expect the Polish market to grow within the next six months. On the positive side, Spain and the CIS markets keep registering promising expectations while the German market, finally, shows an upward trend thanks to an increase in order intakes.

By contrast, the French market continues at the bottom of the ranking even if companies’ reports, especially from those located in the country, are significantly less pessimistic. In the UK, some of the extreme euphoria among dealers has now disappeared (35% rate their situation positive compared to 65% two months ago).