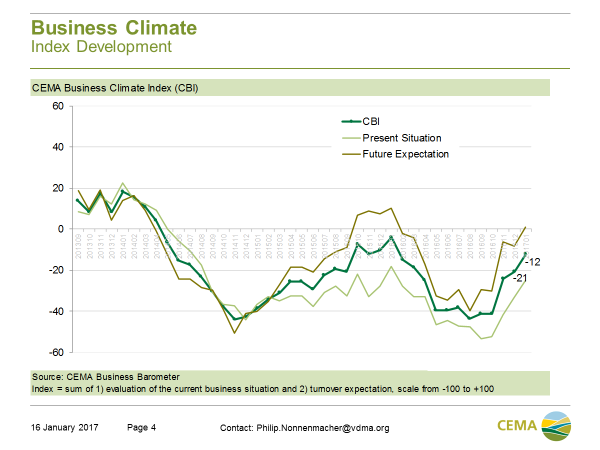

The business mood in Europe’s machinery continues to brighten up. The current business situation has sharply improved. For future business expectations, the index is reaching a positive value for the first time since January last year. Also, a slight majority of manufacturers expects order intake to grow further within the next six months.

Total order intake in December showed positive signs for exports outside of the EU, while some major markets within the EU still remain weak. Incoming orders from outside of the EU are particularly strong for arable and livestock equipment, yet weak for harvesting and tractors.

In the EU, high dealer stock levels of used machinery in Germany, France and Poland might trigger attractive used machinery offers, which could weaken new machinery sales.

Germany has further stabilized regarding turnover expectations for the next six months. The French market has improved as well but continues at the bottom of the European country ranking. In Poland, a market turnaround seems to be reached.

By contrast, dealer stock levels in the UK and in Scandinavia are remarkably below 3-year average. As a result, UK and Scandinavia have reached same positive expectation levels like the CIS and the ongoing top market, Spain.