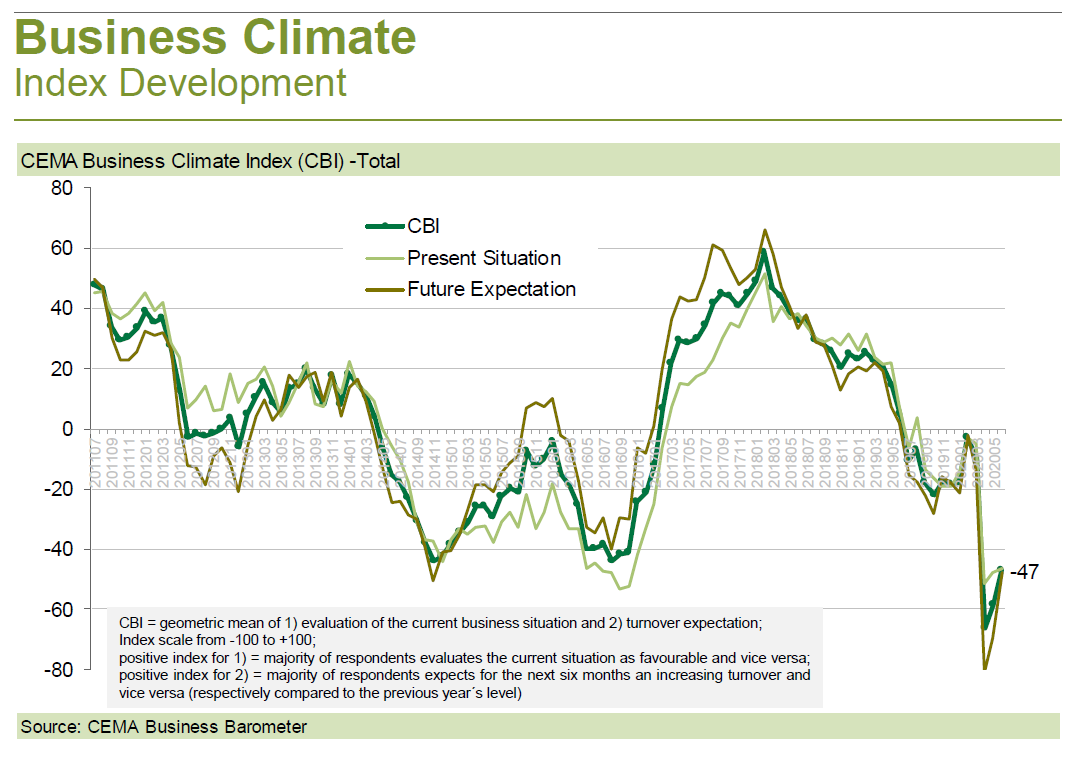

The general business climate index for the agricultural machinery industry in Europe has further improved but continues deeply negative at -47 points (on a scale of -100 to +100) after having dropped as sharply and deeply as it had not since the financial crisis of 2008/09.

The current improvement of the business climate is primarily the result of less negative future expectations. Last month 75% of the industry representatives were expecting a decreasing turnover, whereas in the meantime “only” 56% of the industry representatives expect a decreasing turnover within the coming six months.

Restrictions in the course of COVID-19 are still in place, but have been further reduced along the way to the end customer: on average of all companies participating in the survey, the production capacity utilization is meanwhile at 83% of the level before COVID-19. The conditions on the distribution side have improved the most compared to last month. Overall, however, the distribution side is still causing slightly more problems than the supplier side, which is now again able to supply at 88% of the level before COVID-19.

With regard to the European market, the expectations of the survey participants have also improved, but there is still a clear majority of participants expecting turnover decreases from all regions except Scandinavia.