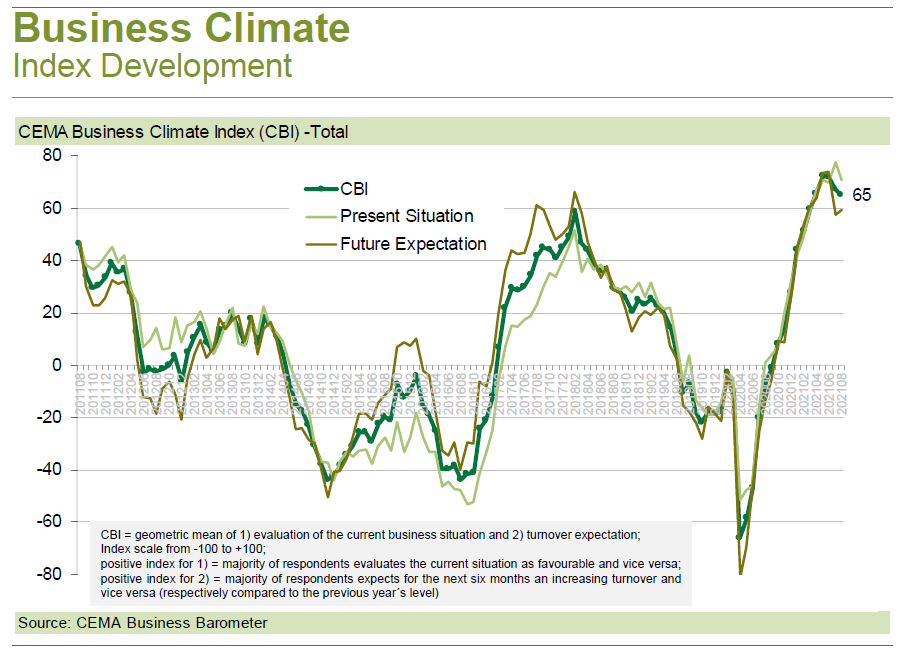

The general Business Climate Index for the Agricultural Machinery Industry in Europe seems to have reached its peak in the months of May and June (with highest levels since 2008). In August, the index decreased slightly for the second month in a row (to 65 points on a scale of -100 to +100).

The volume of orders correspondents currently to a production period of 4.7 months, which is the highest value ever recorded within this survey. However, with regard to expectations for the coming order intake (an indicator which does not feed into the general Business Climate Index), the share of optimists has again dropped and the share of pessimists has continued to rise. Even more uncertainty surrounds to what extent the orders can be realized against the backdrop of extreme price increases and shortages on the supplier side. 31% of the companies expect a production stop due to a lack of certain parts in the coming month.

With view to the European market side, the regional breakdown still shows for each single market a majority of survey participants expecting turnover increases in the next six months. Italy continues undoubtedly at the top of the European market ranking. The expectations are likewise positive for Poland, Germany and France, however, with more mixed views. Austria remains a very strong market, but may have already reached the peak of its growth.