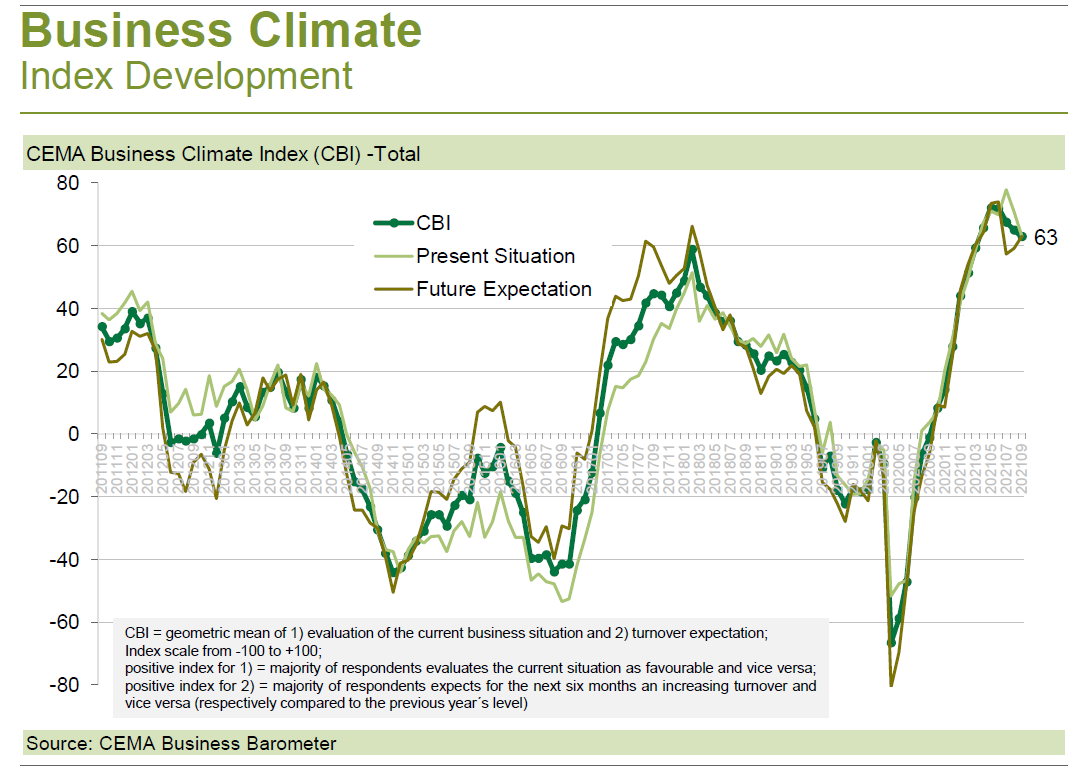

The general Business Climate Index for the Agricultural Machinery Industry in Europe seems to have reached its peak in the months of May and June (with highest levels since 2008). In September, the index decreased slightly for the third month in a row at a high level (to 63 points on a scale of -100 to +100). The drop this time is the result of some companies evaluating their current business slightly less favourably.

Uncertainty continues as to what extent the orders can be realized against the backdrop of extreme price increases and shortages on the supplier side. Meanwhile, 40% of the companies expect a production stop due to a lack of certain parts in the coming month.

On the other hand, demand from end customers in Europe seems to remain robust. The industry still sees a high need for investment for almost all of Europe, especially among farmers within Central to Eastern Europe. Accordingly, the regional breakdown shows for each single European market a majority of survey participants expecting turnover increases in the next six months, with the CIS countries having moved up the most in the market ranking.

Against this background, the European industry representatives remain confident of closing the year with strong results. With regard to the full year 2021, the survey participants expect for their company a turnover increase of +13% (arithmetic mean) or +10% (median).