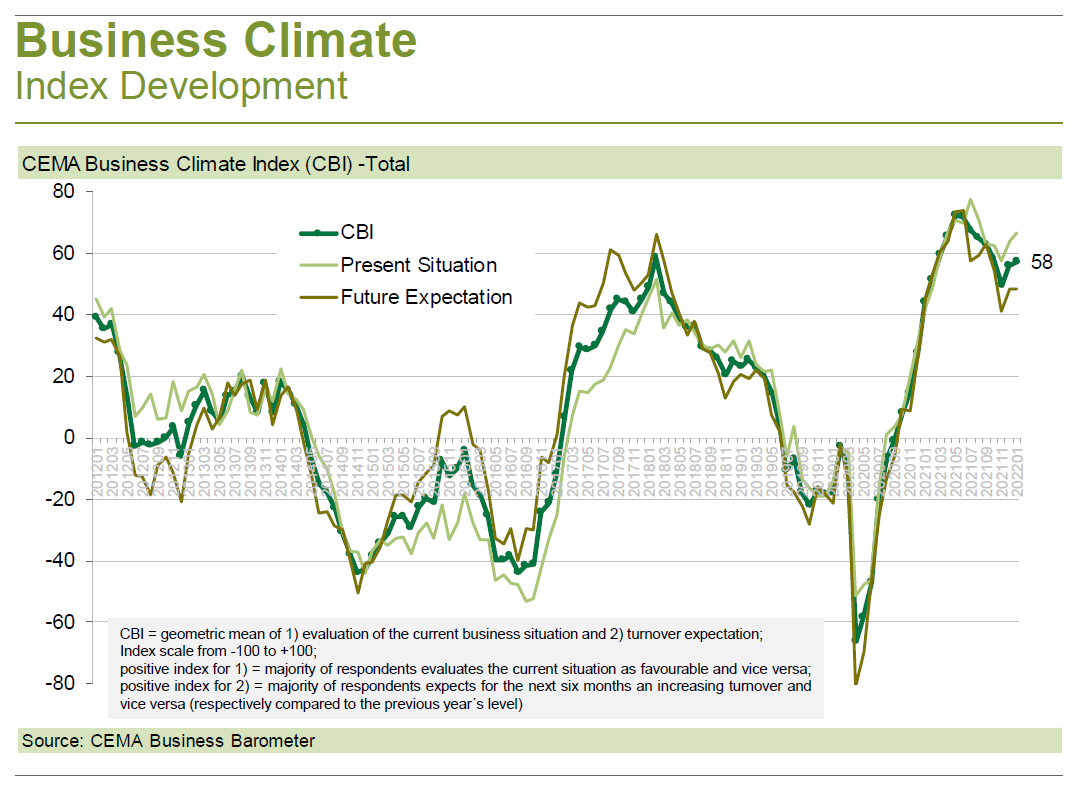

The general Business Climate Index for the Agricultural Machinery Industry in Europe has further stabilized at high level after several months of slight downward correction since its record peak in May and June (where it reached its highest level since 2008). In January, the index increased slightly to 58 points (on a scale of -100 to +100).

With regard to expectations for the coming order intake (an indicator which does not feed into the general Business Climate Index), skepticism has meanwhile spread among industry representatives (more pessimists than optimists for the first time since the end of 2020).

However, for the moment, the manufacturers continue to be faced with a very dynamic order intake from the dealer side - despite order books at record levels. According to the survey, dealer stocks with new machines have been significantly reduced over the past months and thus may have already fallen below the optimal level in most of the markets. Likewise, the used machinery stock has been generally cleansed.

Consequently, the near future turnover is already secured and there is still growth potential for the time being, which might initially merely be delayed into the coming months due to the supply bottlenecks. Price increases and shortages on the supplier side appear to have moderated slightly, but continue to challenge the industry heavily. Once again almost half of the companies are planning a temporarily production stop due to a shortage of certain parts in the coming four weeks.