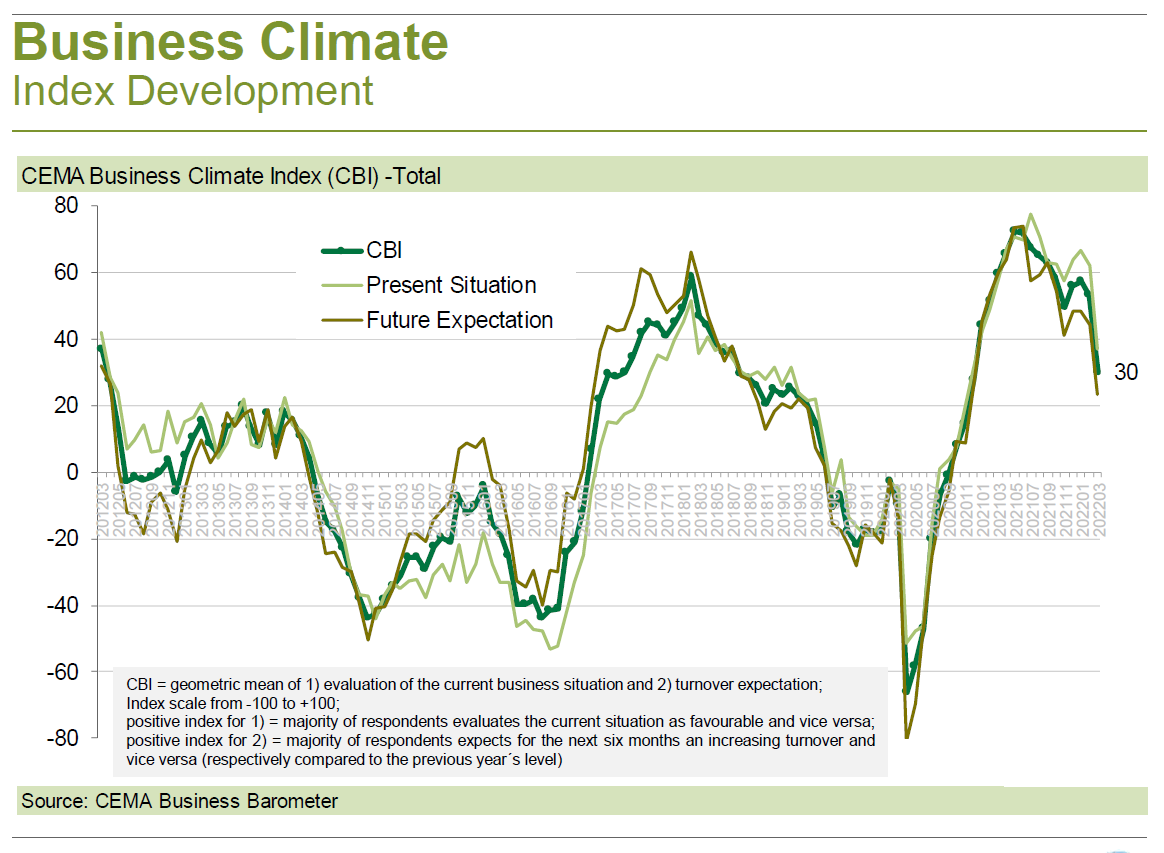

The general business climate index for the agricultural machinery industry in Europe has dropped as sharply as it has not since the crash in the wake of COVID-19, but remains at high level even after this drop. In March, the index decreased from 53 to 30 points (on a scale of -100 to +100).

With regard to the full year of 2022, the European industry representatives still forecast a +5% increase in turnover for their company. According to the survey, the expected lost turnover from Eastern Europe will be more than counterbalanced by further growth in the rest of the world, especially in North and South America, Western Europe, Australia and New Zealand.

The consequences of the Russian war against Ukraine seem to harm the industry more on the already previously constrained supplier side than on the market side. Belarus, Russia and Ukraine together accounted in 2021 for not even 5% of the total turnover of the surveyed companies. Against the backdrop of record order stocks, it might thus be bearable to lose orders from these countries. Rather, it appears to become even more difficult to realize orders as supply bottlenecks and price increases tend to intensify. This applies in particular to the combine harvester and tractor manufacturers, where respectively 81% and 70% are forced to temporarily stop production in the coming four weeks.