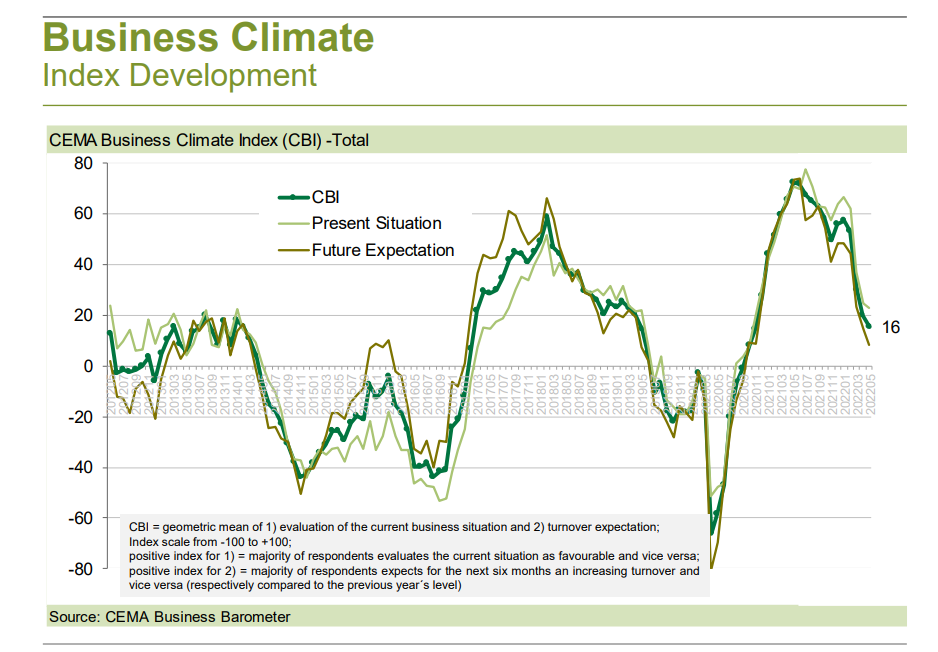

The general business climate index for the agricultural machinery industry in Europe has continued to decrease after its sharpest drop since the crash in the wake of COVID-19, but is in total still holding at a positive level. In May, the index decreased from 20 to 16 points (on a scale of -100 to +100).

The volume of orders corresponds currently to a production period of exactly 6 months, which is just slightly below the all-time high ever recorded within this survey. However, the reason for the large order backlog is now clearly no longer new demand, as the new order intake is meanwhile cooling down noticeably (from very high levels).

The industry representatives are accordingly no longer entirely optimistic with regard to future turnover from some markets, but currently it is almost purely the price increases and bottlenecks on the supplier side that continue to challenge the industry heavily, even though these appear to diminish slightly. Still, nearly half of the companies are planning a temporarily production stop due to a shortage of certain parts in the coming four weeks and expect this to result in a production shortfall of 18% on average for this period.