Demand for tractors is stable, despite fewer registrations in 2018 due to EU legislation

PRESS RELEASE

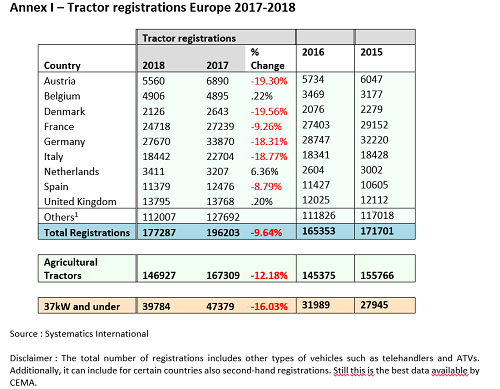

Paris, 27 February 2019 - Overall, a total of approximately 177,000 tractors were registered across Europe in 2018, according to numbers sourced from national authorities. Of these registrations, 39,784 tractors were under 50 hp and, consequently, 137,503 above 50 hp. CEMA considers that 146,927 of these vehicles are agricultural tractors, the rest being quads, telehandlers or other equipment. An overview of the total tractor registrations in each country can be found in the annex.

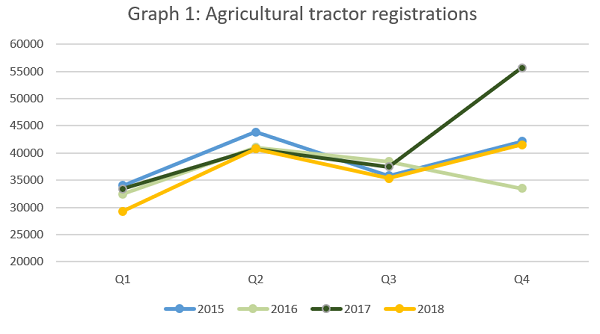

Agricultural tractor registrations declined by around 12% in comparison with 2017. Despite this decline, 2018 is considered to have been a positive year for tractor sales. The reason is that the decline in registrations was caused by a high number of pre-registered tractors in December 2017. New legislation for tractors came into force on 1 January 2018, which meant that all tractors that were only in compliance with the previous technical requirements had to be registered before the introduction date. This resulted in a peak in registrations in December 2017 without an increase in underlying demand. These pre-registered tractors will mostly have been sold in 2018, but sales of these tractors are not taken into account in the 2018 registration figures.

Graph 1 clearly shows that registrations in December 2017 peaked and, subsequently, were relatively low in the first quarter of 2018. When estimating the trend without this unusual peak and trough, it becomes more apparent that demand in tractors recovered slightly in 2018.

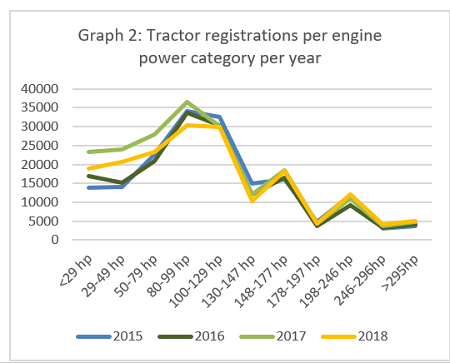

Differences in trends between power categories

When comparing the trends per power category, the number of registrations for tractors above 175hp still increased in 2018 in comparison with 2017, despite the negative impact of the pre-registrations. For the categories below 175hp registrations dropped. This is partly due to the relatively higher number of pre-registrations in the lowest power categories below 75hp.

Furthermore, in graph 2 shows the volatility in demand is much higher in the power category below 100hp.

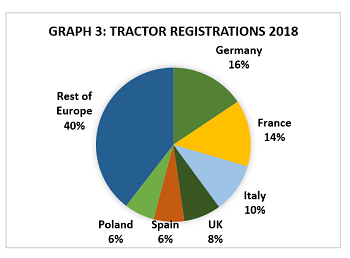

Country differences

As can be seen in graph 3, the two biggest tractor markets are Germany and France. Tractor registrations in these countries declined by 12% and 9% respectively in 2018. The main reason is, as explained before, the pre-registrations for legislative reasons. Sales of tractors in Germany were generally positive, with a small growth experienced. For 2019 sales are expected to go down slightly.

The French market is more optimistic for 2019. Expectations are positive because of the higher farmers income in France

Italian farmers are not confident about the economic situation and investments are down. This is illustrated by lower demand for tractors, combines and trailers in 2018. In 2019 it is expected the Italian market will remain stable at the same level as last years.

2018 was a good year for the UK market for agricultural machinery. Demand for tractors was up by 1% and this could be much more, if it weren’t for the pre-registrations. Sales of arable equipment were particularly strong, with 15-20% more units sold in 2018 in comparison with 2017. For the UK market the developments in 2019 depend mostly on the outcome of the Brexit negotiations. Hence, the market development in 2019 is difficult to predict.

The Spanish market is heavily impacted by the new European requirements for tractors as well as national requirements for trailed equipment. Therefore, a large number of pre-registrations was necessary for trailers and trailed machines in December 2018. This increased demand in 2018 but will have a negative impact in 2019. The impact of the 2017 pre-registrations for tractors led to 10% fewer tractors registered in 2018. However, growth is expected in 2019.

The Belgian harvests were hit by the long period of drought in the summer. Consequently, the Belgian agricultural machinery market decreased with approximately 5% in 2018 and for 2019 it is expected it will remain at the same level. Tractor registrations alone were down with 6% in 2018.

In other markets of the CEMA network the tractor registrations showed strong declines in Austria (-19%), Turkey (-43%) and Denmark (-20), while there was a smaller decrease in the Netherlands for agricultural tractors (-5%).

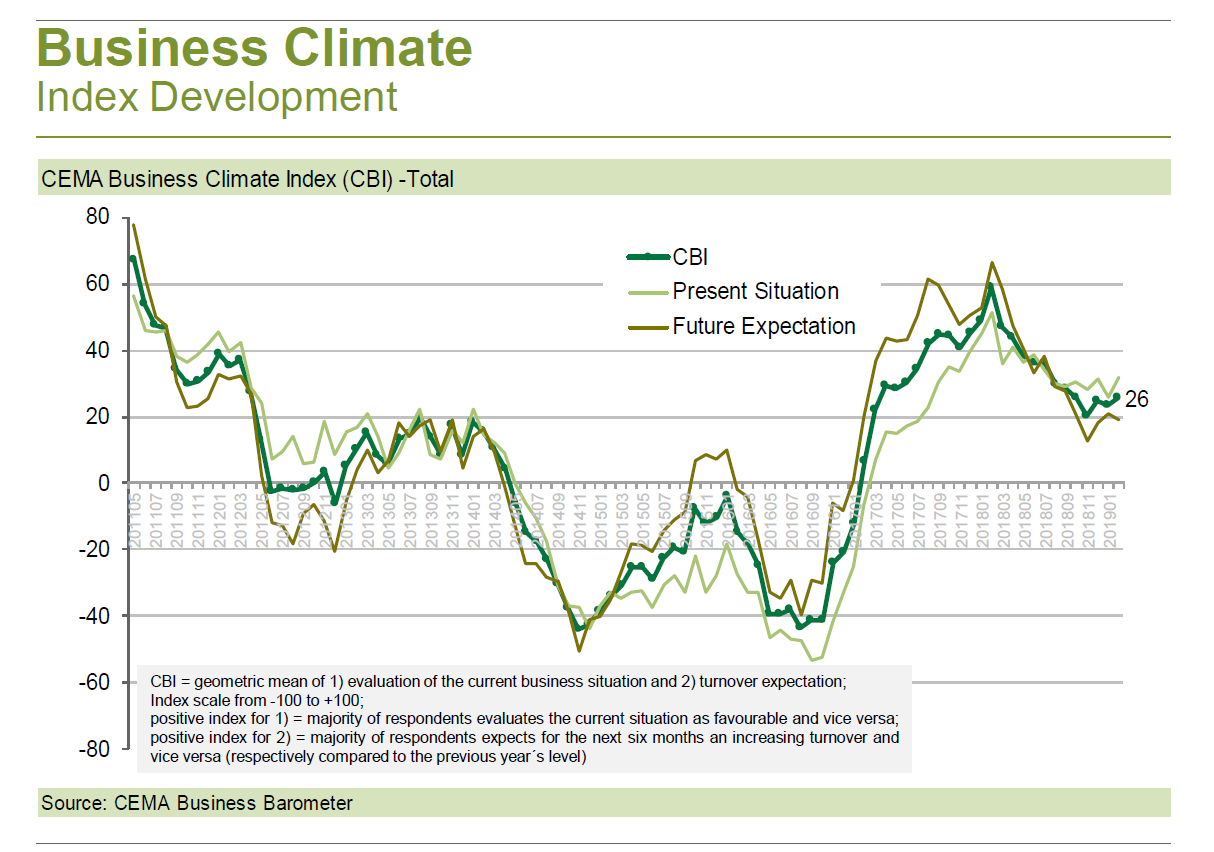

CEMA Barometer confirms positive trend

The positive trend from 2018 and 2019 is also confirmed by the CEMA barometer (graph 5) with a positive evaluation of the current business climate as well as future expectations. The CEMA business barometer is a monthly survey that is sent to the European agricultural machinery industry and covers all the major product categories. It provides a regular overview of the business mood based on current business sentiment and the expected turnover in the next 6 months.

[1] Bosnia Herzegovina, Croatia, Czech Republic, Estonia, Finland, Greece, Hungary, Iceland, Ireland, Latvia, Lithuania, Luxembourg, Moldova, Norway, Poland, Portugal, Serbia & Montenegro, Slovakia, Slovenia, Sweden and Switzerland.