Press Release: European tractor registrations lower in 2023 as demand slows in second half

Download the PRESS RELEASE

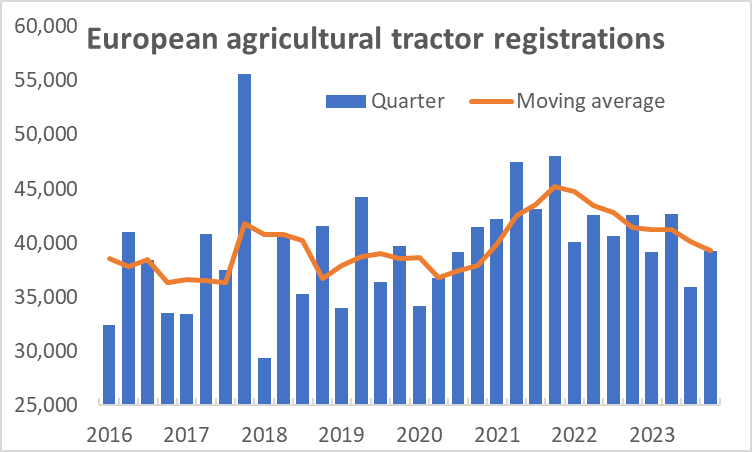

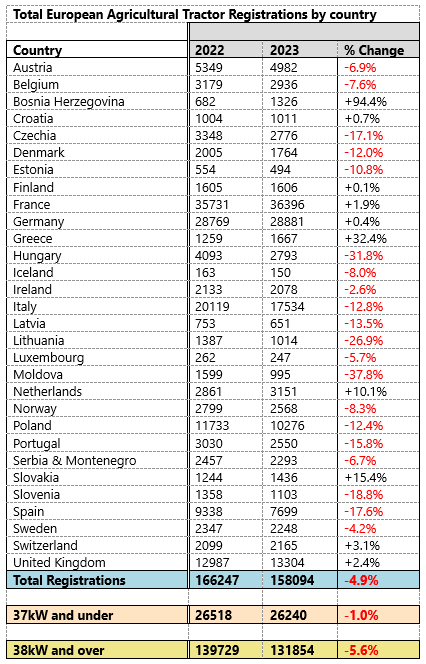

Brussels, 30th April 2024 - Overall, 211,700 tractors were registered across Europe[1] in 2023, according to numbers sourced from national authorities. CEMA considers that 158,100 of these vehicles are agricultural tractors, of which 26,200 tractors (17%) were 37kW (50 hp) and under and 131,900 (83%) were 38kW and above. The rest are made up of a variety of vehicles which are sometimes classified as tractors, which includes quad bikes, side-by-side utility vehicles, telehandlers and some other types of equipment. An overview of the total agricultural tractor registrations in each country can be found in the annex.

Agricultural tractor registrations were 4.9% lower than in 2022 but were only slightly below the average number registered in the last five years. The number of machines registered in the first half of the year was only marginally lower than in the same period the year before, but the decline was sharper in the second half of the year. Between July and December 2023, nearly 10% fewer tractors were registered than in the equivalent period of 2022. The slowdown in the market also meant that registrations in the second half of the year were 7% below the seasonal average.

Chart 1 - Source Systematics International, formatted by CEMA

Chart 1 - Source Systematics International, formatted by CEMA

One of the reasons that agricultural tractor registrations held up well in the first half of 2023 was that manufacturers were catching up with the backlog of orders which had built up during 2021 and 2022, as a result of disruptions to global supply chains during and after the Covid-19 pandemic and the Russian invasion of Ukraine. By the middle of the year, supply chains had largely returned to normal, so the number of tractors being registered gave a better indication of demand in the market.

Agricultural commodity prices have fallen, while input costs are still high, affecting farm incomes

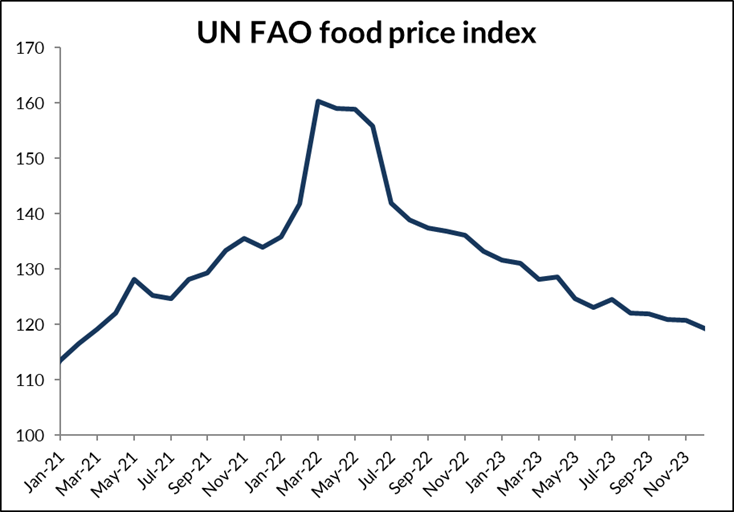

As always, demand for tractors and other types of agricultural machinery is closely linked to farm incomes. Prices for most agricultural commodities spiked during 2022, following Russia’s invasion of Ukraine, which raised concerns about availability of grains and oilseeds, in particular. That had a knock-on effect on the price of animal feed, which meant prices for animal products were also much higher. That supported farm incomes and, in turn, drove additional demand for machinery.

However, since the summer of 2022, global food supply chains have adjusted to the new situation and food prices have come down steadily. By the end of 2023, world food prices, as measured by the UN’s Food & Agriculture Organisation, were down by more than a quarter, compared with the peak in March 2022 and were more than 10% lower than a year before.

Chart 2 - Source UN FAO, formatted by CEMA

Chart 2 - Source UN FAO, formatted by CEMA

The drop in prices for agricultural commodities has come at a time when the costs of inputs to farming production remain high. As well as expensive animal feed, prices for fertiliser, fuel and energy were all exceptionally high during 2022. While they have since come down, they remain more expensive than they were in 2021 and before.

Farmers in many parts of Europe have also been affected by adverse weather conditions over the last year. In combination with falling agricultural commodity prices and high input costs, this means farm incomes have been squeezed. That has inevitably had an impact on farmers’ willingness to invest in tractors and other agricultural machinery, which explains why tractor registrations began to fall in the second half of 2023. As always, there are some local factors affecting markets in individual countries, some of which are explained below.

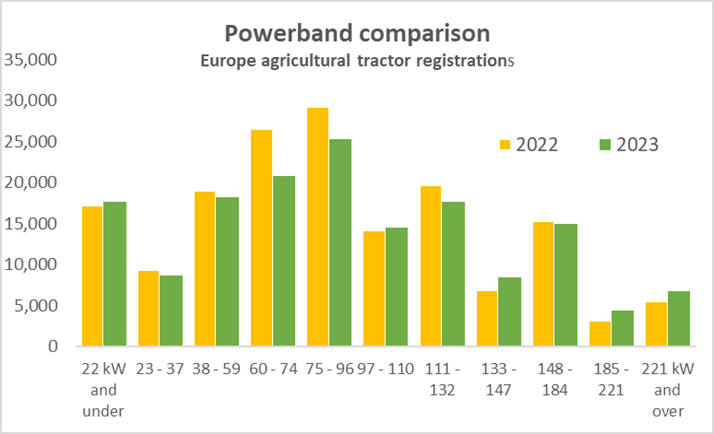

Registrations grow at the top of the tractor power range

Although tractor registrations were lower in 2023 than the year before, that wasn’t true for all power bands. The highest power bands, machines above 132kW (approximately 175hp) saw strong growth, with registrations of these larger tractors up by 12% year on year. In contrast, 13% fewer tractors were registered between 60kW and 132kW (80-175hp), although this range still made up almost half of the agricultural tractors registered in 2023. There was a small decline in the number of tractors under 60kW registered in Europe, with some growth for the smallest machines. The figures quoted underestimate the total size of the market for low-powered tractors, as not all of them will be used on the road, meaning that they do not need to be registered in some countries.

Chart 3 - Source Systematics International, formatted by CEMA

Chart 3 - Source Systematics International, formatted by CEMA

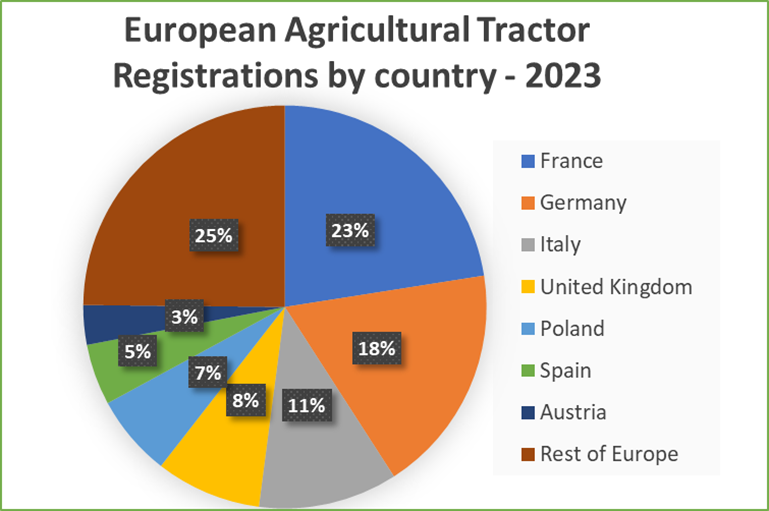

Significant country differences remain across Europe

Not all countries recorded a decline in registrations in 2023. Indeed, the two largest markets, Germany and France, both recorded small increases. That meant their combined share of European registrations increased to 41%. The United Kingdom also recorded slightly higher registrations than in 2022. In contrast, registrations were lower in the other four top markets - Italy, Poland, Spain and Austria. Some of these countries have suffered from particularly challenging weather conditions over the last year, while changes to government grants for purchasing machinery have also affected some markets.

Chart 4 - Source Systematics International, formatted by CEMA

Chart 4 - Source Systematics International, formatted by CEMA

In reviewing the Registration numbers across Europe, economic experts from CEMA national associations further commented[2]:

In Germany, tractor registrations in 2023 were at the same good level as in the previous year. A total of 30,336 new tractors were registered, of which 28,881 were classed as agricultural tractors. The cumulative annual result shows a minimal change, compared to 2022. The market for smaller agricultural tractors up to 38 KW shrank by 4%, while there was a slight increase of 1% in the larger power classes, from 38 KW, compared to the previous year. A slowdown in German tractor registration figures is clearly visible from the second half of 2023.

In France, the first registrations of agricultural tractors rose by +2% in 2023, compared with 2022, to 36,396 units (there were 35,731 in 2022). This is the highest level since 2014. Standard tractors had a percentage increase of +4%. Telescopic loaders (which are not included in the figure for agricultural tractors) and green space tractors also performed well, with increases of 4% and 2%, respectively. First registrations of vineyard and orchard tractors, however, were down 11% on the previous year, as were vineyard straddle tractors (-25%).

In Italy, the unfavourable economic situation, combined with the delay in public incentives for the purchase of innovative agricultural machinery, slowed down the domestic tractor market in 2023, after the high sales volumes of the previous two years. Registration data showed a 13% drop for tractors, mainly affecting tractors from 57 to 130 kW (-23%) and those over 130 kW (-14%). Low power categories, from 20 to 56 kW, recorded a smaller contraction (-5%). The 0-19kW power range saw an increase in registrations by 63%. This positive trend for small tractors is partly due to a recent amendment to the Highway Code, which has allowed non-professional farmers to register agricultural machinery.

In the United Kingdom, the total number of agricultural tractors registered in 2023 was 2% higher than the year before. Having grown by almost 5% in the first half of the year, the market declined marginally in the second half and particularly in the final quarter (-7%). With the exception of the pandemic affected year of 2020, the UK tractor market has been remarkably stable of late, with registrations falling between 13,000 and 14,100 in six of the last seven years. Growth in 2023 was mainly seen at the top and bottom of the power range, with 15% more machines over 160hp and 8% more below 90hp but 13% fewer in between. Given the supply chain disruptions of earlier years, those trends might reflect the availability of machines of different powers as much as demand for them. With growth mainly at the top of the power range, the average power of agricultural tractors registered during 2023 increased to 157.7hp, over 4hp higher than in 2022 and beating the previous record set in 2020.

In Spain, the tractor market reached its lowest level ever recorded due to the impact of various variables. The severe drought in 2023 led to a fall in the value of arable crops, but this was mainly felt in the market for used tractors (-5%). The registration of ATVs, UTVs and telehandlers (considered as tractor substitutes) increased by 11%, but the total number of 1069 units is not enough to justify the reduction of around 1500 units in the tractor market since 2022 (-18%). To get a better understanding of the decline, it is necessary to distinguish between the markets for standard tractors and narrow-track tractors (NTT). The registrations of NTT dropped by 36% in 2023, due to the implementation of the new exhaust emission stage, while standard tractor registrations decreased by just 3%. The implementation of the subsidies for the promotion of precision farming technologies had a key role in the demand of tractors in 2022 and 2023, since many farmers delayed their purchases while waiting for subsidies which represented almost half of the investment. The second batch of subsidies released in mid-2023 had an impact in the second semester, though the market seemed to recover during those months due to the registration of 2022 subsidised units.

In Poland throughout 2023, 10,300 new tractors were registered. This was 12% less than in 2022, when the number of new agricultural machines of this type registered was 11,700. An obvious downward trend can be observed among new agricultural machines, since 2022 also saw lower registrations than the - admittedly record-breaking - 2021. The worsening situation, and pessimistic predictions of the future within the industry, are the result of, among other things, rising energy prices, inflation, uncertainty related to the war in Ukraine and difficulties with selling agricultural produce (e.g., grain). Additional obstacles for farmers were also created by the hastily adopted Act on Lombard Loans in the spring of 2023, which introduced chaos in the market for the sale of new agricultural machinery, making it largely impossible to lease them.

In Belgium, agricultural tractor registrations reached a total of 2,788 units, which is 8% less than in 2022 (source: Fedagrim). This decline may not be abnormal, as 2021, fueled by the pandemic, was a record year in terms of sales across all power ranges. Therefore, it seems that the market is adjusting and returning to its pre-boom level, after a period of saturation. Furthermore, a comparison with previous years shows that the sales in 2023, although down by nearly 300 units compared to 2022, are similar to what was observed in 2018 and 2019, before the Covid-19 pandemic. The market for registered tractors over 50 hp fell by 11% but the decrease in registrations for tractors below 50 hp was not as significant, with a decline of 6.5%. However, this comes after a 20% decrease between 2021 and 2022. It is worth noting that these models are not consistently registered; tractors that are not used on public roads (solely on private property, for instance) are not registered with authorities and therefore do not show up in the statistics. The indecisiveness of the regional government of Flanders regarding the 'nitrogen' issue, has created a lot of uncertainties. This constitutes an additional explanation for the decline in sales.

In the Netherlands, 2662 tractors were registered with Fedecom through the official channels of tractor importers in 2023. That is 6% more than in 2022. This means that we have seen small growth for tractors above 45 KW for the last four year. In the compact segment (<45KW), the official number is 761 tractors, which represents growth for the sixth consecutive year. The numbers in the compact segment undercount the total as not all companies participate in the Fedecom statistics. The increase in the number of tractors above 45 kW is remarkable given the poor market conditions. Uncertainty throughout the agricultural sector, unclear legislation and regulations, and the lack of clear policy when it comes to nitrogen, for example, are not having a positive influence on sales figures.

The agricultural tractor market in Austria, which is still in a good situation, has fallen by 7% compared to 2022 but is still substantially higher than in the pre-Covid year of 2019. The materials and inputs required to manufacture tractors are more readily available again, and prices for them are still rising, but to a lesser extent. That means that the market has returned to a more normal situation but, with farm incomes reduced, it has only been possible to pass price increases on to customers to a limited extent.

77,901 tractors were registered in Türkiye in 2023. Tractor sales increased by 16% compared to 2022, and were 54% higher, compared with the average of the 2018-2022 period. Subsidised agricultural loan interest rates, which are low compared to the high inflation in Turkey, positively affected the demand for tractors in the first three quarters of the year. In addition to normal demand, the concern that prices will increase further in an environment where high inflation continues has brought forward tractor purchasing decisions. While this naturally affected demand significantly, problems on the supply side of tractors prevented supply from meeting demand. This has significantly increased the demand for imported products, which respond to demand faster. Due to the increase in loan interest rates and the difficult loan conditions in the last quarter of the year (except December), there has been a contraction in the domestic market since September.

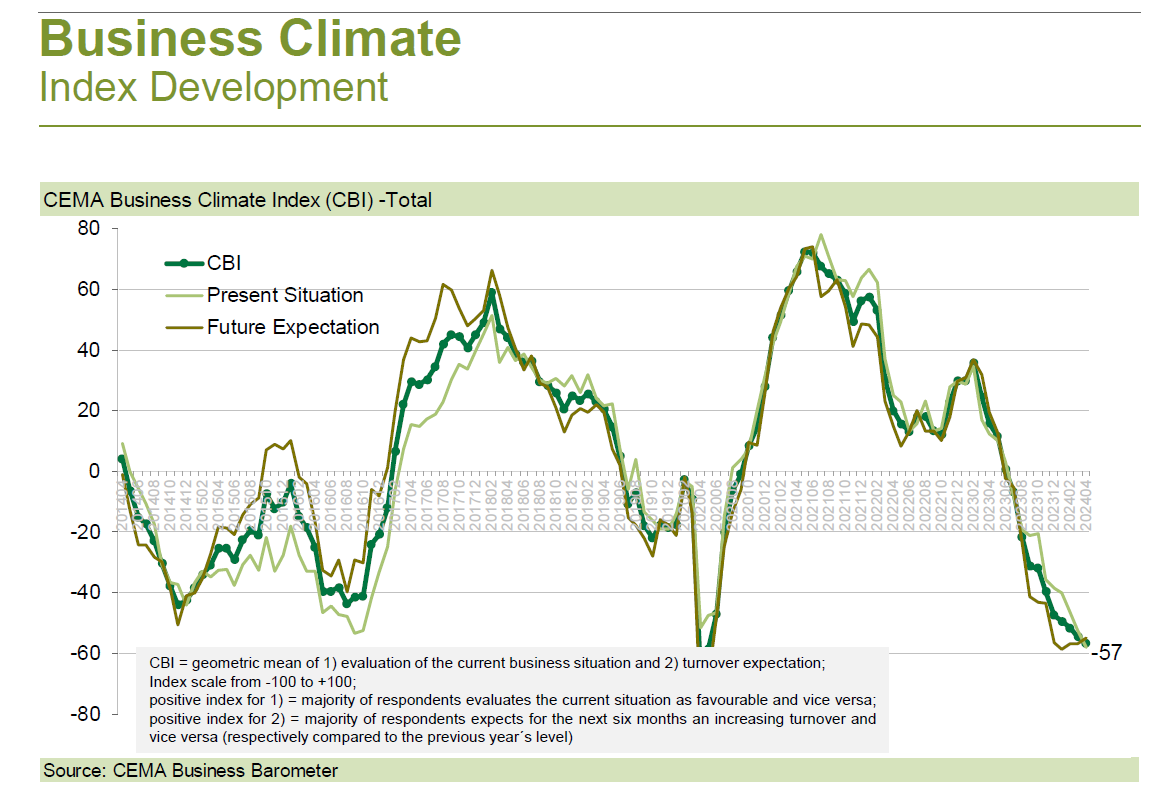

CEMA Barometer

The general business climate index for the agricultural machinery industry in Europe has again deteriorated slightly following the sharp downturn of the previous months. In April, the index decreased from -55 to -57 points (on a scale of -100 to +100).

The survey confirms again that the direct customers of the manufacturers, the dealers, are not able to pass on their numerous orders from the past to end customers. According to the survey, dealer stocks in most European markets are significantly higher than they were even in 2019, which went down in history due to high dealer stock levels.

The renewed deterioration in the business climate is, for the second month in a row, solely due to current business evaluations having followed the already lower expectations for the future downwards. According to the survey participants, current business is worse than it has been for more than seven years. Only 5% of industry representatives consider the current business situation to be favourable.

The renewed deterioration in the business climate is, for the second month in a row, solely due to current business evaluations having followed the already lower expectations for the future downwards. According to the survey participants, current business is worse than it has been for more than seven years. Only 5% of industry representatives consider the current business situation to be favourable.

On the other hand, future expectations have stabilised at a low level. Even so, two thirds of survey participants expect their turnover to decline in the coming six months. Meanwhile, a further and significant improvement can be seen in expectations for the coming order intake (an indicator that is not included in the calculation of the overall barometer index).

- ENDS -

Annex:

Source: Systematics International, formatted by CEMA

Source: Systematics International, formatted by CEMA

Disclaimer: the total number of tractor registrations reported may differ from those published my national authorities, which can include other types of vehicles such as telehandlers and ATVs. Additionally, for certain countries it can include some second-hand registrations.

[1] Figures cover most EU markets and some non-EU countries. See Annex for full list of countries included.

[2] Numbers may differ from those indicated in the Annex table, due to slight differences in how agricultural tractors are defined in each country.