Download the PRESS RELEASE

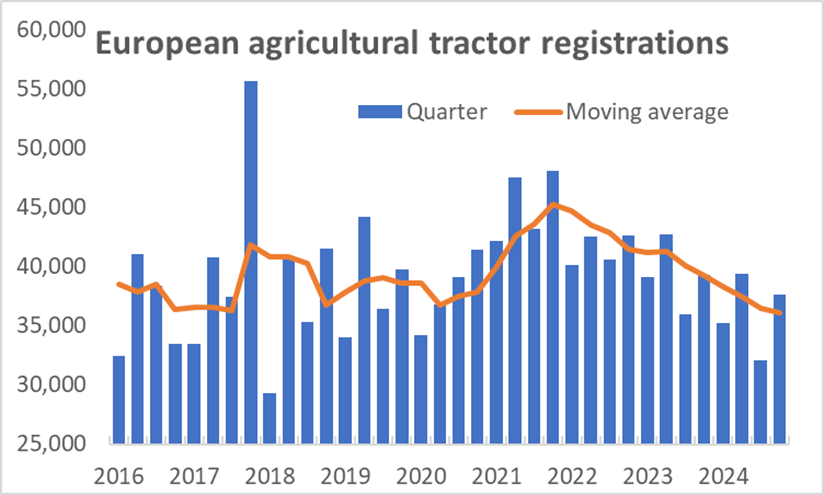

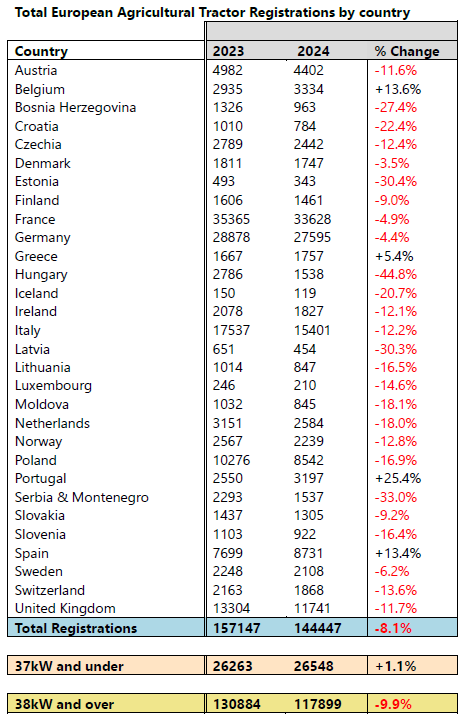

Brussels, 8th April 2025 - Overall, 204,500 tractors were registered across Europe[1] in 2024, according to numbers sourced from national authorities. CEMA considers that 144,400 of these vehicles are agricultural tractors, of which 26,500 tractors (18%) were 37kW (50 hp) and under and 117,900 (82%) were 38kW and above. The rest are made up of a variety of vehicles which are sometimes classified as tractors, which includes quad bikes, side-by-side utility vehicles, telehandlers and some other types of equipment. An overview of the total agricultural tractor registrations in each country can be found in the annex.

Agricultural tractor registrations were 8.1% lower than in 2023 and were at their lowest level since at least 2014. Registrations reached a recent peak during 2021 and have since declined for three years in a row, dropping by 20% in that time.

Chart 1 - Source Systematics International, formatted by CEMA

Chart 1 - Source Systematics International, formatted by CEMA

The disruptions to global supply chains as a knock-on effect of Covid-19, which had a big impact on the European tractor market in 2021 and 2022, were largely behind us by the start of 2024. The effective closure of the Suez Canal to commercial shipping did cause some challenges but they only had a very limited impact on tractor manufacturers. Therefore, the reduced level of registrations in 2024 reflects a lower level of demand for tractors from Europe’s farmers and growers. There are a range of factors that combined to drive this trend, including: reduced profitability for farmers in some key agricultural sectors, lower availability of government support for investment in machinery and adverse weather conditions in many parts of Europe.

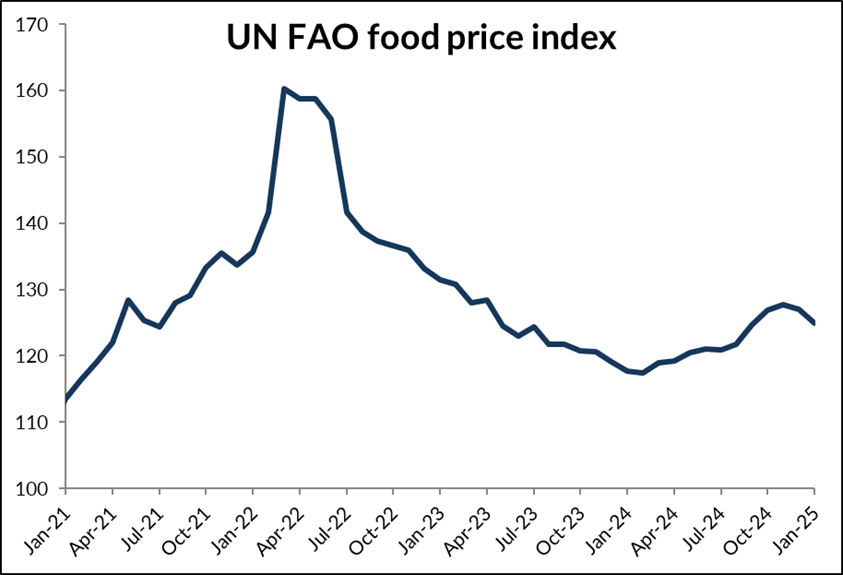

Agricultural commodity prices have fallen, while input costs are still high, affecting farm incomes

As always, demand for tractors and other types of agricultural machinery is closely linked to farm incomes. Prices for most agricultural commodities have come down a long way since they spiked in 2022, following Russia’s invasion of Ukraine. Although global markets have stabilised since mid-2023, with some even recovering slightly, price levels are little higher than they were before they began rising in 2021. Once inflation is taken into account, prices for many agricultural products are now lower than they were four years ago, including most arable crops.

Chart 2 - Source UN FAO, formatted by CEMA

Chart 2 - Source UN FAO, formatted by CEMA

At the same time, many inputs to agricultural production are more expensive than they were four years ago. In real terms (i.e., after accounting for inflation), energy and fuel was 23% more expensive and fertiliser prices were up by a quarter. Across all farm inputs, the increase was 7% over that period. As a result, EU farm incomes dropped by 10% in real terms in 2023 and it is expected that they will have dropped further in 2024.

In part, that is because of lower prices but it is also because poor weather in many parts of Europe had an impact on the size of the summer’s harvest. Much of Northern and Western Europe experienced periods of heavy and sustained rainfall over the last year, affecting field operations and hitting both the area of crops grown and their yields. Further South and East, hot and dry conditions at times during the year have had a similarly adverse impact on crops. The likelihood of reduced incomes as a result of this will affect farmers’ willingness to invest in tractors and other agricultural machinery.

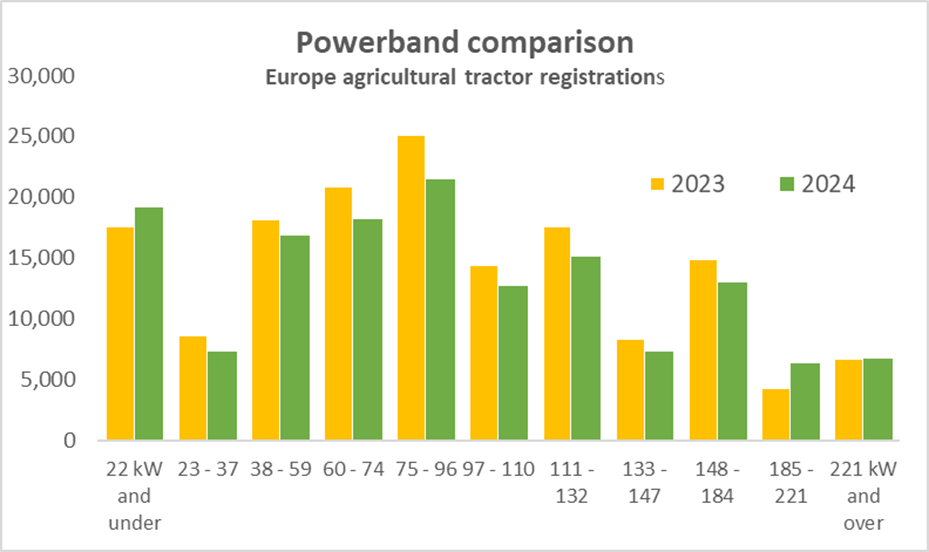

Registrations grow at the top of the tractor power range

The year-on-year decline in total agricultural tractor registrations was apparent across most of the power range, with the exception of the smallest tractors (22kW and under), which saw a small rise, and the largest ones. Above 185kW (approximately 250hp), nearly 20% more tractors were registered in 2024, compared with a year earlier. Those larger machines still only accounted for 9% of the European total but that is significantly higher than the 7% share in 2023.

Chart 3 - Source Systematics International, formatted by CEMA

Chart 3 - Source Systematics International, formatted by CEMA

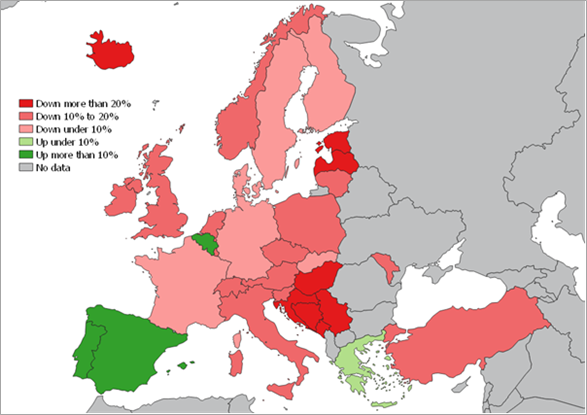

Only a handful of European countries registered increased numbers of agricultural tractors in 2024, compared with the same period last year. These include Spain and Portugal, where improved weather conditions allowed the market to begin to recover from recent lows. The two largest markets, France and Germany, both recorded below average declines (-5% and -4%, respectively). In contrast, several countries in South East Europe saw particularly big declines in tractor registrations.

Change in agricultural tractor registrations by country, 2023 - 2024

Chart 4 - Source Systematics International, formatted by CEMA

Chart 4 - Source Systematics International, formatted by CEMA

Data for Turkey are not included in the European totals discussed above, partly because the large number of tractors registered there would otherwise dominate the figures. Its registrations were equivalent to almost half of the total for the rest of Europe, even though they recorded an 18% year-on-year fall in 2024, to 63,600 machines.

In reviewing the Registration numbers across Europe, economic experts from CEMA national associations further commented:

In Germany, tractor registrations in 2024 were below the good level of the previous year. The cumulative annual result shows a decline of 4% compared to 2023. The market for agricultural tractors up to 38kW shrank slightly and in the mid-range classes (from 38 to 110 kW) the percentage declines were even larger, in the double digits. Meanwhile, there was a slight increase in the largest power classes, from 110kW upwards, compared to the same period of the previous year.

In France, just over 34,000 tractors of all classes were registered for the first time in 2024. This is 7% less than in 2023. First registrations of standard tractors fell for the first time since 2020 (-8% in 2024) to 23,976 units. The average power of standard tractors continues to rise, reaching 169 hp in 2024 (compared with 163.5hp in 2023). Of particular note is the strong growth in the number of tractors with a power of more than 300hp (+13%). First registrations of vineyard and orchard tractors fell sharply for the third year running, to their lowest level in ten years (2,531 units). In 2024, average power remained stable at 89.1hp. First registrations of landscaping / gardening tractors rose by 9% in 2024, to 6,718 units. This is the highest total ever, apart from 2017, which was marked by an artificial boom in registrations linked to the change in engine standards. The structure of registrations by power band has changed little in recent years. Other tractor types accounted for 816 units in 2024, up +8,5% compared to 2023.

In Italy, the national agricultural machinery market closed 2024 with a significant decrease in sales. The decline affected all of the main types of machinery, starting with tractors which, with approximately 15,400 units registered, dropped 12% from last year, marking the worst performance since 1952. All the power range classes declined except for the 0-19kW that showed an increase of 19% at the end of the year. The sector, after peaking in 2021, saw its third consecutive year of decline, with the downward trend being primarily influenced by the increase in production costs and high interest rates, making access to credit difficult. On the other hand, the second hand tractor market reached another peak, with more than 57,000 units sold (+8% comparing to 2023); many are very old machines with an average age of about 22 years.

In the United Kingdom, agricultural tractor registrations dropped below 12,000 machines in 2024 for the first time since 2020. In six of the seven previous years, the total was between 13,000 and 14,100, so the 2024 figure was well below average. It was similar to the levels seen in other recent years when the market has been depressed, often due to the weather, though. The annual total was 12% lower than the previous year and is actually the lowest annual total since 2016. The only brighter spot was at the top end of the power range, with over 1,500 tractors above 240hp registered during the year, around 14% more than in 2023 and a record high. That meant the average power of tractors registered during the year reached over 160hp, also a record.

In Spain, investment in agricultural tractors, which accounted for 53% of total investment in agricultural machinery, continues to determine its importance in the economic analysis of the sector. However, other self-propelled vehicles, such as ATVs and telescopic handlers, continue to increase their presence in the market, whereas two decades ago this was the exclusive preserve of agricultural tractors. Agricultural tractors registered as ‘work and service tractors’ are also continuing to increase their market share, which lead to the psychological barrier of 9,000 units being crossed in 2024. These 440 units do not appear in the register of agricultural tractors, although they can be used for agricultural operations. In terms of power, only registrations of narrow tractors from 80-100hp showed a decline, although these tractors account for only 6% of the total market. Power ranges from 100-150hp account for 38% of the market, having increased their presence by 17% compared to 2023, and from 151-200hp, 15% after a rise of 13%. The best performers in 2024 are tractors over 200 hp, which, with a 26% increase, now account for a fifth of the market. The registration of second-hand agricultural tractors also grew again in 2024, serving as an indicator of the positive development of the new tractor market in the medium term.

In Poland, 8,500 new tractors were registered, which represents a 17% decline, compared to 2023. The biggest drop in sales, at 27%, was observed in the 140–200hp segment. Sales of small-power specialised tractors (up to 30hp) remained steady compared to the previous year. The main reasons for the decline in tractor and agricultural machinery sales in Poland include the deteriorating financial situation of farms due to rising production costs and uncontrolled grain imports in the first quarter of 2024. These factors, along with geopolitical instability in Eastern Europe and economic uncertainty in Poland, result in unpredictability in agriculture. Currently, farmers investment decisions and purchases of tractors are driven by genuine needs of agricultural holdings.

In Belgium, agricultural tractor registrations reached 14% more than in 2023. Unlike the situation in Europe, tractor sales in Belgium experienced a market recovery after two difficult years. In 2024, a total of 2,158 tractors of over 50hp were registered in Belgium. This represents an increase of more than 300 compared to 2023 and is 100 more than the five-year average. In 2023, registrations reached the lowest point in many years, linked to legal uncertainty regarding the nitrate plan, which led to low investment willingness. In 2024, there were just over 1,000 registrations of lighter tractors (50 hp and under), which is below the five-year average. These tractors are also used outside of professional agriculture. The share of the highest power tractors (over 250 hp) continues to grow, from 13 % in 2021 to 22.5% in 2024. The 180-250hp category remains stable, while the share of tractors under 180 hp is gradually decreasing.

In the Netherlands, the sale of new tractors above 45kW fell slightly in 2024. The cause lies mainly in the uncertain political decision-making at national level and the lack of a clear point on the horizon for farmers. The income of farmers, both in arable farming, horticulture and livestock farming, was above average in 2024 but uncertainty always slows things down. Tractors have been registered in the Netherlands for two years and based on this data we can see that many (used) tractors are being purchased from abroad in the Netherlands. Based on all license plate registrations, we see a number of 4100 tractors for 2024. The expectation for 2025 is negative, with the number of farmers in the Netherlands steadily decreasing and a large number of farmers expected to make use of a buyout scheme offered by the government.

In Austria, The Austrian tractor market, which remains in a healthy state, declined by 5% compared to 2023 but is still approximately 10% above the pre-COVID year of 2019. The materials and inputs required for tractor production are more readily available again, and prices remain high. Passing these price increases on to customers is only possible to a limited extent.

In Turkey, a range of factors have had a very negative impact on the sector dynamics. These include the general economic conditions in the country, high interest rates and difficulties for agricultural enterprises in accessing credit, product prices falling below expectations after harvest, a vicious cycle of high inflation and low exchange rates and the general contraction in world markets have As a result, a significant contraction was experienced in the domestic market. In Turkey, 63,546 tractors were registered in 2024, a decrease of 18% compared to the same period last year. The increased involvement of private banks in tractor loans and tractor companies' contributions to banks for lower interest rates prevented the market from showing a more dramatic decline.

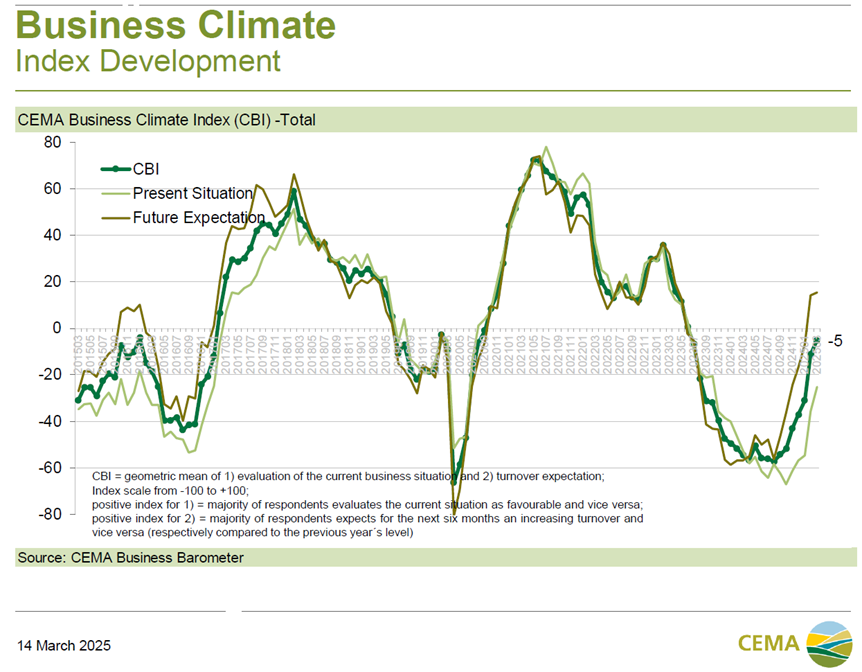

CEMA Barometer

The general business climate index for the agricultural machinery industry in Europe has further consolidated its recovery after entering the upswing zone in February 2025. In March 2025, the index increased from -11 points to -5 points (on a scale of -100 to +100).

While the recent recovery in the general business climate has so far been driven primarily by improving general turnover expectations, it is now a significantly improved evaluation of the (still negative) current business.

With a view to the market side, the confidence index has once again improved for nearly all European markets. In the meantime, among others, confidence with regard to the Polish market has significantly recovered, with Poland now leading the European market ranking together with Spain and Italy. When considering the rest of the world, towards non-European markets, industry representatives are by far the most confident with regard to Latin America.

With a view to the market side, the confidence index has once again improved for nearly all European markets. In the meantime, among others, confidence with regard to the Polish market has significantly recovered, with Poland now leading the European market ranking together with Spain and Italy. When considering the rest of the world, towards non-European markets, industry representatives are by far the most confident with regard to Latin America.

For the full year of 2025, the survey participants expect their company's turnover to slightly increase on average (median and arithmetic mean +3%).

- ENDS -

Annex:

Source: Systematics International, formatted by CEMA

Disclaimer: the total number of tractor registrations reported may differ from those published my national authorities, which can include other types of vehicles such as telehandlers and ATVs. Additionally, for certain countries it can include some second-hand registrations.

[1] Figures cover most EU markets and some non-EU countries. See Annex for full list of countries included.